Many people are aware of the important role the credit rating plays in their lives. However, understanding what actually goes into a credit score (the credit score breakdown) might present a bit more difficulty. There are several different methods of scoring, but most lenders and banks rely on the FICO method that has been in existence since the 1980’s when it was developed by the Fair Isaac Corporation. The three prominent credit bureaus (TransUnion, Experian and Equifax) all worked with Fair Isaac in order to come up with the FICO method.

Your credit score may be any number from 300 to 850. The average American falls at about 690 which is deemed relatively good credit. However, while this score should secure you a loan, it will not get you the very best interest rates on a loan.

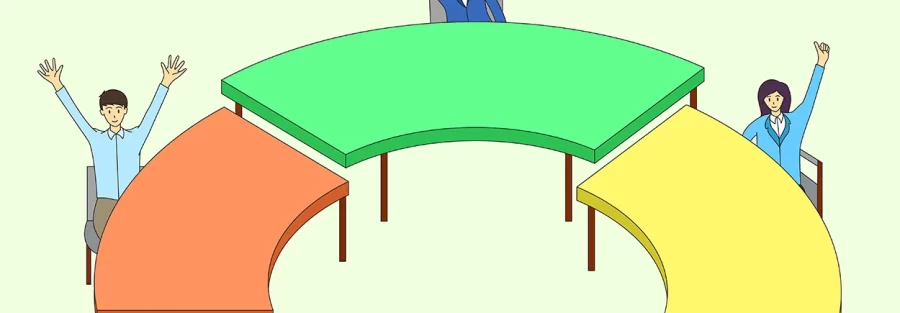

Following is the credit score breakdown:

Payment History. The biggest chunk of your score (35%) is derived from your payment history. This score is influenced by how well (or not) you pay your bills on time, how many have been sent to collection agencies, bankruptcies, tax liens, etc. Keep in mind that missing a payment is worse than making a late payment and that being late or especially missing a mortgage payment is a bigger blow to your credit score than missing a credit card or utility payment.

Outstanding debt. The amount of debt you have (compared to the amount of credit you have not used) accounts for 30 percent of your score. Try not to max your credit cards out. In fact, it is recommended that you only use 25 to 50 of the credit that is available to you. A way to balance this out is to obtain more lines of credit and not use them. However, you do not want to apply for a bunch of credit cards all at once as this is marked against you. If your credit is in good standing, apply for a reputable card every six months or so and save it for a rainy day.

Credit duration: Fifteen percent of your credit score is based on how long you’ve established credit. This is common sense. The longer your credit history, the better your overall score will be. More data about your past leads to a more accurate prediction of your future credit worthiness.

Types of credit: Having several types of credit will actually boost your score if they are managed well. This counts for 10 percent of the overall rating.

Too much activity: As mentioned earlier, opening new credit accounts all at once will negatively affect your score in the short term. It’s also important that you are aware that your score can be lowered for too many “hard inquiries” about your status. A “hard inquiry” is one that you have authorized a lender to perform. If you are inquiring about your own score, this will not count against you.

Understanding what goes into the credit score breakdown is the first step in improving your score.